Alpha Weekly #17:Underrated Interoperability Plays ft. Across and Connext

PLUS: Move-based L2s

Gm, this is Alpha Weekly, your weekly dose of crypto alpha driven by smart on-chain intelligence.

Here’s what we have for you this week:

📈 Weekly Accumulations

🔄 Underrated Interoperability Plays- Across and Connext

🔭 Macro Watch: Move-based L2s

📈 Weekly Accumulations ft. FJO, BRETT and ETH Restaking

ETH Restaking: The restaking narrative continues to dominate this week as well, as the top 3 tokens accumulated this week are all from restaking projects. ezETH, eETH and rsETH all saw a collective accumulation of ~$750 million.

LBP Fair Launch Meta: The LBP narrative of launching tokens fairly to its community has been slowly picking up steam this cycle. Fjord Foundry (FJO), one of the platforms that facilitates this, witnessed an increased accumulation of ~$20 million this week.

BRETT on Base: The memecoin, BRETT, saw increased on-chain accumulation on Base this week. One of the reasons for this spike is the announcement of perp listing of the asset on Bybit.

🔄 Underrated Interoperability Plays- Across and Connext

As the crypto space becomes increasingly complex with a proliferation of new chains and layer solutions, the critical need for effective bridging and interoperability platforms has never been more apparent. These platforms not only facilitate smoother transitions and interactions among different blockchain ecosystems but also play a pivotal role in enhancing user experience and maximizing efficiency.

Moving assets or data across blockchains can be as cumbersome as exchanging currencies during an international trip, involving multiple steps, exchanges, and high fees. For example, a user wanting to transfer value from an Ethereum-based application to a BNB Smart Chain application must undertake a complex process involving several platforms and transaction layers. This not only complicates the user experience but also increases transaction costs and time, highlighting the need for seamless interoperability solutions.

Currently there are two huge players in this space— LayerZero and Wormhole. However, the competition is getting exciting with more innovative and promising projects jumping into the fray. In this post, we’ll focus on two such projects:

Across (ACX)

Connext (NEXT)

Across Protocol

What is Across? Across Protocol uses intents and UMA’s optimistic oracle to create a bridge that enables quick and secure transactions across different blockchains.

Performance Metrics:

In March, Across saw all-time high bridging volumes of approximately $1.1 billion.

It recorded about 24,000 intent-filled transactions on April 4th, indicating robust engagement.

Supported by UMA, which secures approximately $779 million in assets.

Consistently ranks as the fastest and most cost-efficient bridging solution in aggregator volume share comparisons.

Recent Updates: Recently, Across announced a partnership with UniswapX to enhance protocol synergy, focusing on leveraging advantages in auctions and intents. It has also received a significant proposal approval for 1M ARB from the Arbitrum LTIP, bolstering its resources and capabilities.

Future Roadmap: Across is looking to increase its capabilities with the potential use of TVL behind the EigenLayer for bridges, explore more frequent repayments to improve capital efficiency, and continue its expansion in supporting new chains and enhancing user experience with innovative upgrades like the Dencun Upgrade.

On-Chain Metrics (ACX):

There has also been an increase in on-chain accumulation of ACX in the past week both from Top Holders and Fresh Wallets.

With around $70 million in market cap and only ~4.7k holders, this seems to have a lot of potential for growth as more on-chain users are onboarded.

Connext Protocol

What is Connext? Connext is a protocol designed for secure and scalable cross-chain transfers, utilizing a modular framework that supports a wide array of blockchain networks.

Performance Metrics:

The protocol’s bridge TVL from Ethereum is among the largest by volume.

Achieved over $1 billion in monthly bridge volume.

Network uptime of 99.4% with high rates of fast transfer completion.

Supported growth in network usage with a 50x increase in volume across its bridging solutions.

Recent Updates:

Expanded support to include additional chains like Metis L2, Modenetwork, and Base.

Introduced the Restake From Anywhere module, enabling ETH native restaking on L2s in partnership with RenzoProtocol.

Future Roadmap: Connext aims to further its growth by enhancing its intent model, expanding its footprint across more chains and ecosystems, developing solutions for settling intents across numerous chains, and increasing the adoption of the xERC20 token standard. The team is focused on moving beyond Proof-of-Concept stages to support a broader number of chains and assets, promising more announcements and collaborations.

On-Chain Metrics (NEXT):

With the market cap of the project at around $20 million, a lot of Top Holders and Fresh wallets have been accumulating increasingly in the past few weeks. This indicates conviction and a potential for repricing soon.

NEXT saw a total buy volume of ~$2.1 million in the month April. This can be considered a bit low and indicates that it still hasn’t received much attention, which is great for accumulating before the volume and repricing come.

Interoperability platforms like Across and Connext are not just facilitators but essential pillars that support the broader vision of improving the UI/UX of crypto. By addressing and simplifying the current fragmentation and isolation among chains, these platforms are paving the way for a more connected and efficient blockchain future. They are two platforms to watch for in this cycle.

🔭 Macro Watch: Move-based L2s

The current landscape of Ethereum L2s is red hot. Apart from the big names like Arbitrum, Base and Optmisim, there are many more in the wings, trying to capture attention and liquidity. Standing out in this landcape is difficult and very few new L2s manage to do it and excite EVM developers. However, Movement Labs emerges as a formidable player, aiming to redefine how we build and interact with smart contracts.

Leveraging Facebook’s innovative Move Virtual Machine (VM), Movement Labs is not just another addition to the L2 scene but a force ready to disrupt Ethereum(L2) solutions. Recently, Movement Labs secured a significant $38 million in a Series A financing round led by Polychain Capital, signaling strong investor confidence and the potential for substantial growth. Founded by the dynamic duo of Rushi Manche and Cooper Scanlon, two Vanderbilt college dropouts, Movement Labs is on a mission to make blockchain security accessible and engaging.

With this recent infusion of capital and leadership driven by a clear vision, Movement Labs is poised to accelerate its development. In this post, we wanted to highlight what they are building and their current ecosystem to unlock early opportunities.

What is Move?

Move is a programming language developed originally by Meta (formerly Facebook) for its crypto projects, Libra. Designed to be safe and flexible, Move is unique in its ability to handle assets as individual, indivisible entities. This capability ensures transactional integrity and prevents duplication, thereby enhancing the security framework for blockchain operations.

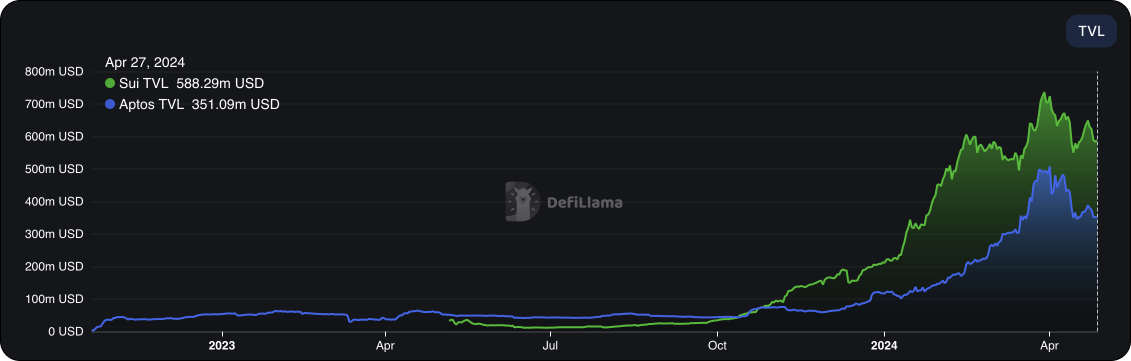

Beyond Movement Labs, Move has been adopted by other significant blockchain projects such as Aptos and Sui, which are layer-1 blockchains emphasizing low fees and high throughput. Their adoption of Move underscores the its potential to create a new standard of secure and efficient blockchain operations.

Movement Labs and How is It Different from Existing Ethereum L2s

Movement Labs is an ambitious initiative that brings Facebook's Move VM to the Ethereum ecosystem. Unlike traditional Ethereum L2s, Movement Labs focuses on superior transaction speeds, enhanced security, and greater scalability. It distinguishes itself by using Move programming language, which is set to offer more organized and secure asset management and smart contract development compared to the standard EVM.

Movement Labs introduces several key features:

High Throughput: By employing Move VM, Movement Labs promises a high transaction per second (TPS) rate, vastly improving over existing solutions.

Decentralized Sequencing: Unlike centralized sequencers that dominate current blockchain architectures, Movement Labs opts for a decentralized approach to balance network load and ensure fairness in transaction processing.

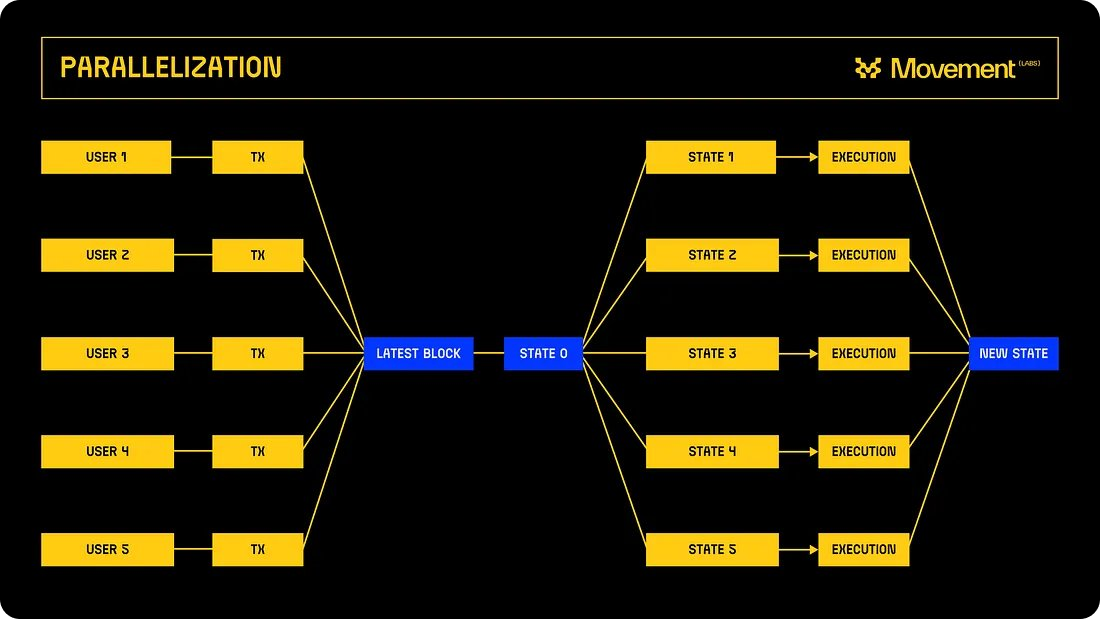

Parallelization: This feature allows simultaneous transaction processing, reducing congestion and gas fees significantly during peak periods. This is similar to what Parallel EVM L1s like Sei and Monad are building.

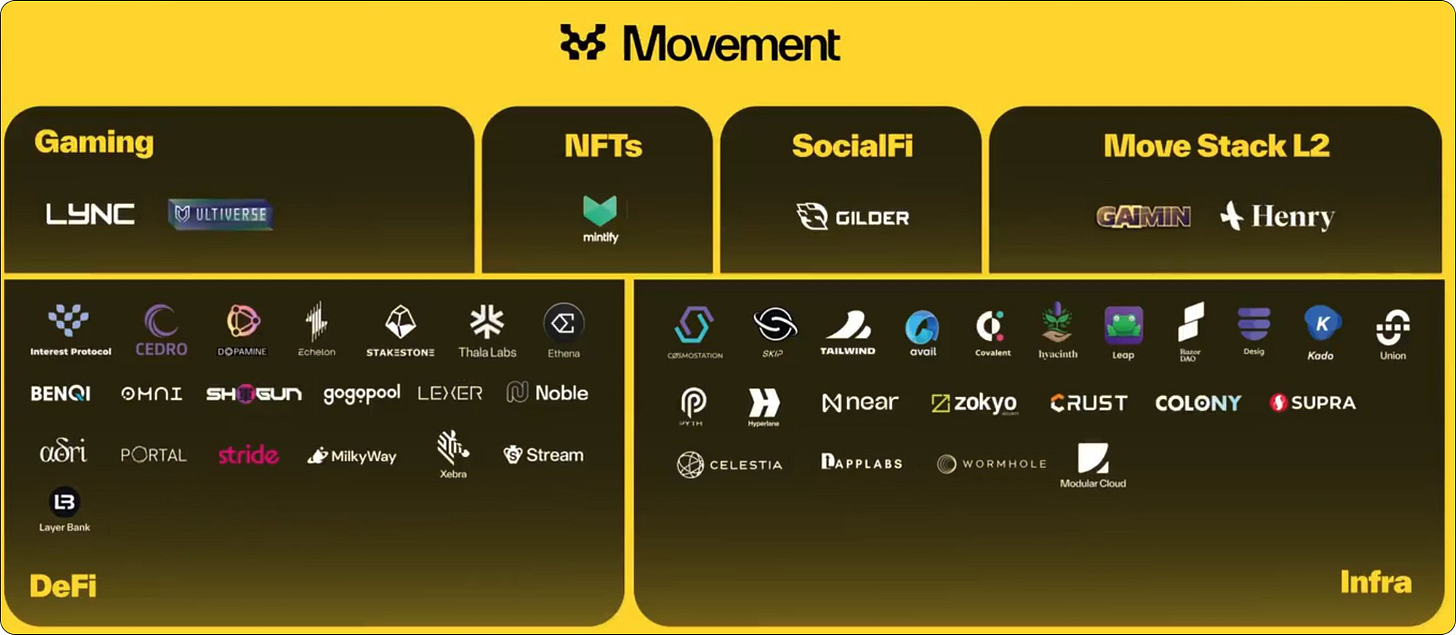

The M2 Ecosystem

M2, the flagship L2 solution from Movement Labs, is still in early stages. However, it is already hosting a variety of projects that leverage its high throughput and security features:

Thala Labs: A comprehensive DeFi platform initially launched on Aptos, expanding to M2 to access a broader audience with its suite of financial products.

Echelon Market: Recently launched on Aptos, it plans to extend its money market services across various blockchain ecosystems through M2.

Stream DeFi: A new DeFi that offer yield bearing vaults will deploy their Delta Neutral vaults on M2. Stream leverages a Decentralized Market Maker (DMM) to shield users from price fluctuations of underlying assets. These vaults enable earning yield in $USDC, $ETH, and $BTC, setting the stage for a future liquidity-optimized decentralized perpetuals exchange.

GaiminIo: A gaming ecosystem utilizing M1 and M2 layers to enhance its operations in the blockchain space.

Hyperlane: Enhances interoperability across different blockchain networks using Move VM.

IPXSui: Already operational on M2’s devnet, this DEX is pioneering the integration of complex trading features on the Move platform.

Movement Labs has found a novel way to standout in the L2 race with its innovative use of the Move programming language and its focus on decentralization and high performance. As the ecosystem continues to grow, attracting more projects and partnerships, Movement Labs is can become a key player in the L2 space, offering a scalable, secure, and efficient platform for decentralized applications.