Alpha Weekly #5: Decentralized Science (DeSci)- A New Scientific Frontier

PLUS: Bridging Wars Are Heating Up!

Gm, this is Alpha Weekly, your weekly dose of crypto alpha driven by smart on-chain intelligence.

Here’s what we have for you this week:

📈 Weekly Accumulations

🔄 Decentralized Science (DeSci)- A New Scientific Frontier

🔭 Macro Watch: Bridging Wars Are Heating Up!

Join our upcoming Chain Intel Session, a live research session where our team analyzes projects, trends, and narratives, using on-chain metrics and tools to uncover the next potential 100x tokens.

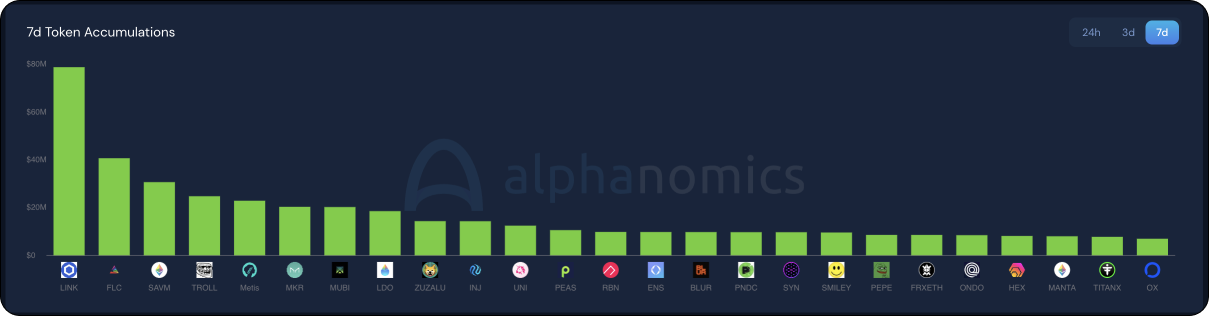

📈 Weekly Accumulations ft. SAVM, ONDO and RBN

SatoshiVM, an EVM-based Bitcoin Rollup Layer 2, launched its token, $SAVM, this week and has already garnered over $30 million in on-chain DEX accumulations. Despite being in its testnet phase, the project is anticipated to have a significant impact on the Bitcoin Layer 2 narrative, as we discussed in our earlier edition.

The RWA narrative is gaining traction this week, fueled by the Coinbase listing of $ONDO, the native token of Ondo Finance. Ondo Finance is an institutional-grade finance platform that specializes in tokenizing real-world assets. In the lead-up to the listing, over $9.5 million worth of $ONDO was accumulated on decentralized exchanges (DEXs) in the past week.

Accumulations in Ribbon Finance ($RBN) surged by around $10 million this week, driven by speculations of an airdrop related to Aevo. Aevo, developed by the Ribbon Finance team, is a pioneering Derivatives Layer 2, mainly focusing on options and perp trading. There's anticipation among the community that $RBN holders might also be in line for an airdrop from Aevo.

🔄 Decentralized Science (DeSci)- A New Scientific Frontier

For far too long, people questioned the practical applications of crypto, often mockingly referring to it as "Fake Internet Money." Initially confined to finance and payments, crypto has significantly expanded its scope in recent years. It has evolved into a crucial element for unlocking digital identities, establishing decentralized physical infrastructure networks, and, more recently, catalyzing advancements in scientific research.

Decentralized Science (DeSci) emerges as a transformative force in scientific research, seeking to liberate researchers from the constraints of bureaucratic and traditional aspects of funding, execution, publishing models and leaving them to pursue what they do best- research and innovate.

While the sector is still in its early stages, we wanted to explore a few projects within it from an investment perspective and delve into their on-chain metrics.

VitaDAO is a collectively owned community that funds early-stage longevity research, with governance vested in $VITA holders. To date, they have allocated more than $4 million in research funding across 20 projects, spanning diverse areas such as Brain Tissue Replacement to RNA therapeutics for longevity.

The Top 5 holders of the token do not control more than 30% of the overall circulating supply.

Despite seeing an increase in Fresh Wallets buy volume, the overall volume in the past week was just over $200k, indicating it’s still flying under the radar.

Research Coin ( $29.7 million MC)

A platform that’s making scientific research accessible to everyone and accelerating the progress of research. Users receive RSC for uploading new content to the platform, as well as for summarizing and discussion research. Rewards for contributions are proportionate to how valuable the community perceives the actions to be - as measured by upvotes.

Both Top Holders and Fresh Wallet buy volume of RSC have been consistently increasing over the past week.

Some of the top accumulators of RSC also hold other DeSci tokens like Data Lake (LAKE) and Athena DAO (ATH).

GenomesDAO is constructing the world's largest genomics database owned by users. They prioritize fair compensation for patients contributing data and establish an immutable record detailing when, where, and how data is utilized. The database is subsequently shared with reputable organizations contributing to medical research.

Already partnered with companies like AMD and Consensys to ensure privacy encryption of all the data.

Fresh Wallet buy volume has been consistently increasing over the past week, with the total number of token holders reaching 2000.

ValleyDAO is a global community funding and supporting synthetic biology research for the sustainable production of various products. The decentralized community funds and incubates academic and independent research projects, facilitating the translation of research into real-world applications

Top Accumulators of GROW, the native token of ValleyDAO, like 0xd28 and 0xeeb have also been accumulating other DeSci tokens like Research Coin (RSC), Data Lake (LAKE) and Genomes DAO (GENE)

Crypto has always been synonymous with promoting permissionless access for everyone. Scientific research, traditionally confined within academia's gates, has suffered from limited exploration and hindered progress.

Decentralized Science emerges as a solution to dismantle bureaucratic barriers that have unfortunately become integral to a researcher's journey. This shift enables scientists to concentrate on accelerating innovation without unnecessary impediments. For investors, the convergence of scientific progress and evolving crypto use cases makes Decentralized Science a compelling field to watch.

🔭 Macro Watch: Bridging Wars Are Heating Up!

New and innovative blockchains are emerging almost every week, ranging from EVM and non-EVM based L1s, modular L2s, to even L3s. Keeping up with the progress in each of these individual ecosystems is becoming increasingly challenging.

In this era of continuous blockchain innovation, effective communication and capital flow between these diverse blockchains are crucial. The ecosystem's capital is expanding, but it remains finite, making seamless interaction between blockchains essential.

As a dApp builder aiming to draw in maximum capital and achieve broad distribution by accessing diverse blockchain ecosystems, the idea of being omnichain becomes increasingly appealing.

If one anticipates the continued growth of more blockchains and the expansion of their ecosystems, looking into infrastructure protocols that facilitate communication and capital bridging between them is a wise move.

Much like the underlying use of oracle infrastructures, bridging and communication infrastructures are already playing a crucial role for numerous dApps and chains.

Among these infrastructure protocols, the current leaders are:

Layer Zero

Wormhole

We believe it is valuable to delve deeper into these protocols across different domains.

Funding and Integrations

In terms of blockchain and dapp integrations, both protocols offer support for major ecosystems like Ethereum, Solana, Arbitrum, Optimism, etc. However, they have also opted to specialize or take the lead in a few emerging ecosystems.

Layer Zero recently announced a partnership with the highly anticipated parallelized EVM chain, Monad. On the other hand, Wormhole has gained an upper hand with the recently trending L1, Sui. Notably, Sui contributed significantly to the bridging volume on Wormhole in recent times.

On-Chain Metrics

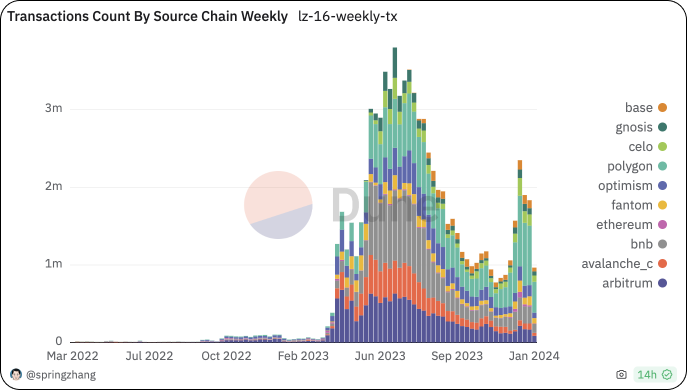

Layer Zero has facilitated over $27 billion in total bridged amount, attracting a user base of 3.8 million. Recent transaction volumes have been primarily driven by activity on Polygon, Arbitrum, and Optimism chains. Although neither Layer Zero nor Wormhole currently has a token, Layer Zero officially stated that one is in the works. This announcement sparked a surge in transaction activity after a prolonged period of decline, with users speculating on a potential airdrop, as evident in the provided data.

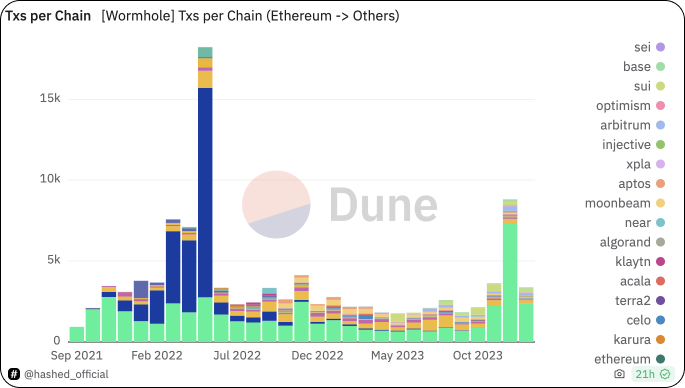

Wormhole has predominantly seen transaction volume from Solana, with Sui closely following. This marks a sharp contrast to Layer Zero, which has been more EVM-centric. The significant volume from the Solana ecosystem can be attributed, in part, to Wormhole’s association with Jump. Like Layer Zero, Wormhole has experienced a notable uptick in transaction activity, driven not only by broader market price movements but also potentially by airdrop farmers.

Economics

As evident from the mentioned metrics, aside from a few areas, both these protocols are neck and neck. However, a notable difference lies in their bridging economics, particularly concerning native ETH and stETH bridges.

Typically, when bridging assets, users pay gas fees on both the source and destination chains, a point of grievance for many in crypto. Recently, Wormhole announced a new bridge that allows users to transfer native ETH and stETH across 7 EVM networks, including Arbitrum, Optimism, Base, etc., without incurring gas fees on the destination chain.

While LayerZero offers cost advantages on various bridging routes, Wormhole's move significantly reduces the cost of ETH transfers on EVM chains, potentially attracting more volume.

In summary, both of these protocols are in a head-to-head competition with their integrations and innovations, simplifying the omnichain approach for numerous dApps. While there are other bridging infrastructure protocols like Connext and Across Protocol actively innovating, neither of them matches the scale of Wormhole and Layer Zero.

Anticipation is building as both protocols are set to launch their tokens this year, introducing another layer of comparison that is set to intensify this competition. It's an exciting narrative to closely monitor.