Alpha Weekly #24: Preparing for Base Memecoin Mania 2.0

PLUS: The First Clearing Layer w/ Everclear

Gm, this is Alpha Weekly, your weekly dose of crypto alpha driven by smart on-chain intelligence.

Here’s what we have for you this week:

📈 Weekly Accumulations

🎢 Base Memecoin Mania 2.0 Loading

🔭 Macro Watch: Chain Abstraction w/ Everclear

📈 Weekly Accumulations ft. ATH, CRV and EZETH

Aethir Cloud TGE: Aethir Cloud, the new decentralised AI project with massive backing, went live with their token launch this week. The token, ATH, saw ~$30 million in on-chain accumulation this week.

Curve Liquidations: This week also saw the Curve liquidation drama, with a lot of collateral on the platform being liquidated. It led to the price of CRV dropping by over 80% for a brief period. The on-chain accumulation of CRV surprisingly increased this week, with close to $70 million accumulated, as investors hope that the issues will be resolved soon.

Restaking Meta: Restaking tokens like WEETH, RSETH, and EZETH are all seeing increasing accumulation indicating the recent FUD around Eigen Layer or Renzo hasn’t affected the market’s interest in ETH yield optimisation. ~$150 million was collectively accumuated this week alone.

🔥 Base Memeceoin Mania 2.0

The first Base memecoin mania from late 2023 to early 2024 saw tokens that had been created months earlier suddenly skyrocket as more attention and capital flowed into Base. Tokens like TOSHI, MOCHI, and DOGINME soared to hundreds of millions of dollars in market cap during that period, having positioned themselves well ahead of the surge. This activity firmly established Base as one of the top Ethereum Layer 2 in terms activity.

With the recent approval of the ETH ETF and more sophisticated projects being actively developed on Base, we anticipate a significant influx of capital soon. And where capital goes, attention follows. And as we have seen these past few months, memecoins have been the primary beneficiaries of this attention. While some of this capital will flow to well-established memecoins, the majority is likely to be invested in newer memecoins that offer better profit multiple albeit, a bit riskier.

In this post, we highlight five memecoins on Base, created within the last three months, that are gaining decent capital inflow from Fresh Wallets and Top holders. These tokens are listed in descending order of market cap value.

Here are a few new Base memecoins to keep an eye on:

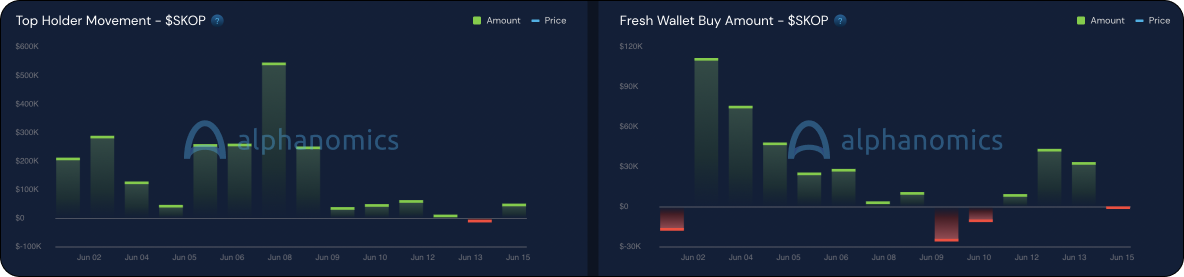

Created in April 2024

Price spiked by 800% in the last week but still seeing increasing Top Holder and Fresh Wallet accumulation.

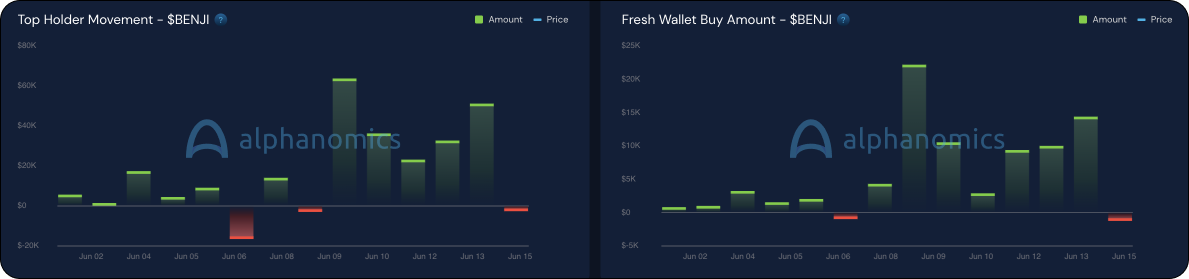

Created in Arpril 2024

Increasing Fresh Wallet and Top Holder accumulation. Over $3.5 million in collective accumulation just this week from these two groups.

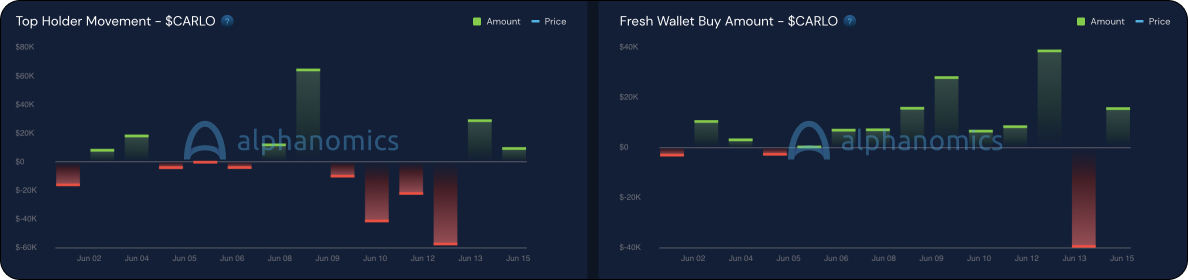

Created in May 2024

Price spiked by 250% in the last few days. After a brief profit taking actions from Top Holders and Fresh Wallets, they have begun to accumulate in the past couple of days.

Created in June 2024

Over $2 million in accumulation from Top Holder this week. Fresh Wallets also consistently increasing position.

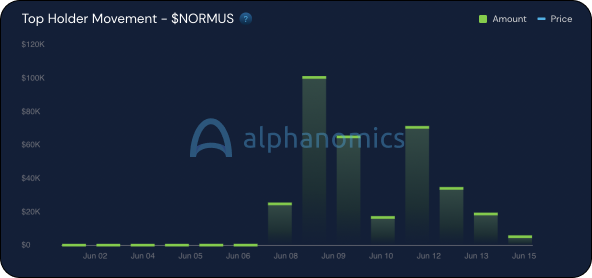

Created June 2024

The token having been created less than a week ago has quickly climbed to a $1 million MC. Top holders haven’t yet sold any of their stake yet and instead have been accumulating more. ~$350k accumulated in the past 6 days.

🔭 Macro Watch: Chain Abstraction w/ Everclear

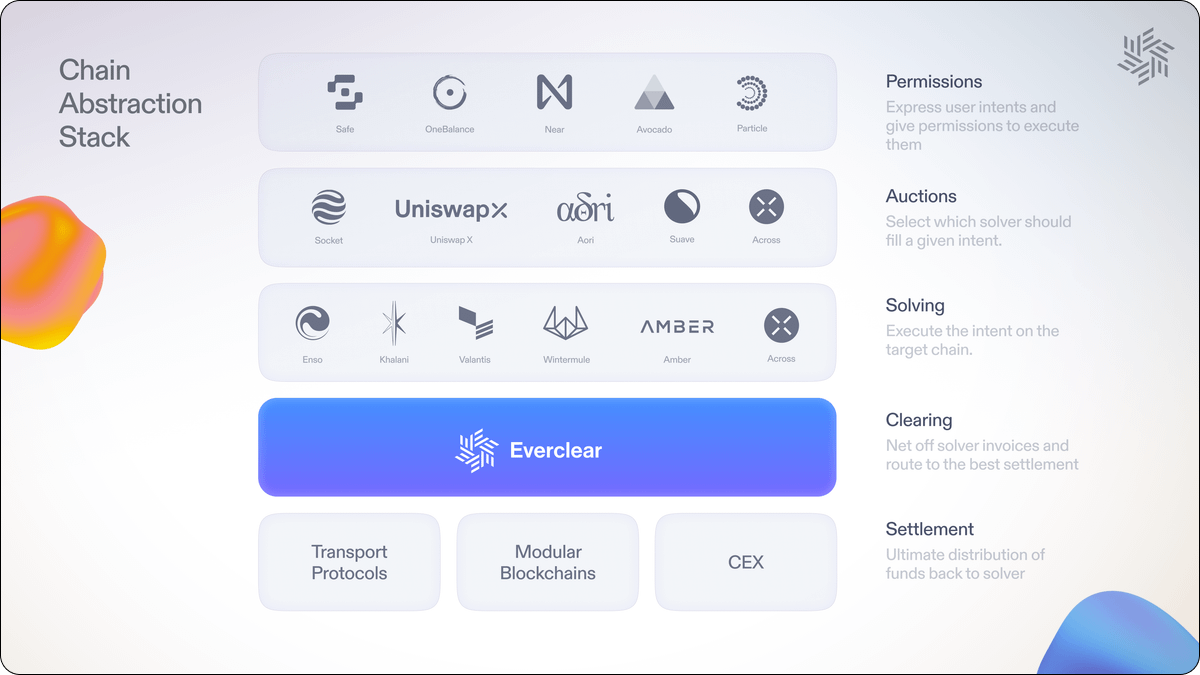

Everclear is the rebranding and evolution of Connext, a platform that we have covered previously and now aims to address the challenge of fragmented liquidity across various chains in the crypto ecosystem. Its approach offers to power optimal liquidity for intent protocols and solvers, facilitating cross-chain interactions efficiently and securely.

Everclear and the Shift from Connext

Everclear serves as a coordinator and global settlement layer for liquidity across all chains, providing a solution to the liquidity fragmentation issue prevalent in modular L1 and L2 blockchains. It has emerged as a significant shift from Connext, focusing on improving rebalancing processes and reducing capital inefficiencies.

Core Features and Use Cases of Everclear:

Intent Protocols: Everclear defines intents as a function of auctions, execution, and settlement. Users broadcast their intent to perform an action on-chain, solvers facilitate and fulfill these requests, and settlement occurs once the intent is repaid on the source chain.

Rebalancing Efficiency: Everclear has made rebalancing 10x cheaper, addressing a long-standing issue in the cross-chain solver market. It has introduced clearing layers, a new layer in the chain abstraction stack, to improve interactions and communication among players.

Modular Infrastructure: It operates as an Arbitrum Orbit rollup using EigenDA in partnership with Gelato RaaS, providing an optimal clearing solution for protocols and solvers. It acts as a shared "computer" for clearing settlements efficiently across the ecosystem.

Market Opportunity:

Capital Inefficiencies: Current solutions exhibit extreme capital inefficiencies, with over 5x the required volume being sent through bridges than necessary. Everclear's approach aims to reduce this inefficiency significantly, potentially saving millions in unnecessary transaction costs.

Cross-Chain Interoperability: As more rollups and Layer 2 solutions emerge, the need for efficient cross-chain interoperability becomes paramount. Everclear's clearing layers offer a solution that could become the standard for interoperability, potentially capturing a significant share of the market as adoption grows.

Everclear's innovative approach to liquidity and settlement is a step towards significant advancement in cross-chain interactions. By introducing clearing layers and optimizing rebalancing processes, Everclear is poised to become a key player in the modular infrastructure landscape. As the Chain Abstraction narrative evolves this cycle, Everclear is definitely one project to follow closely.